Syria, strategically located in the Middle East, holds significant oil and natural gas reserves, although its energy sector has faced numerous challenges due to ongoing conflicts and geopolitical instability. Despite these challenges, the country continues to maintain a degree of energy production capacity that plays an important role in its economy. In this article, we’ll explore the current state of Syria’s oil and gas reserves, key statistics, and the potential for future energy production.

Syria’s Oil Reserves: A Vital Resource

Before the civil war that began in 2011, Syria had been producing a substantial amount of oil, although its reserves were modest compared to some of its regional neighbors. According to the U.S. Energy Information Administration (EIA), Syria’s proven oil reserves stood at approximately 2.5 billion barrels. While this is a relatively small amount in comparison to larger oil-rich nations, Syria’s oil still represents a valuable resource.

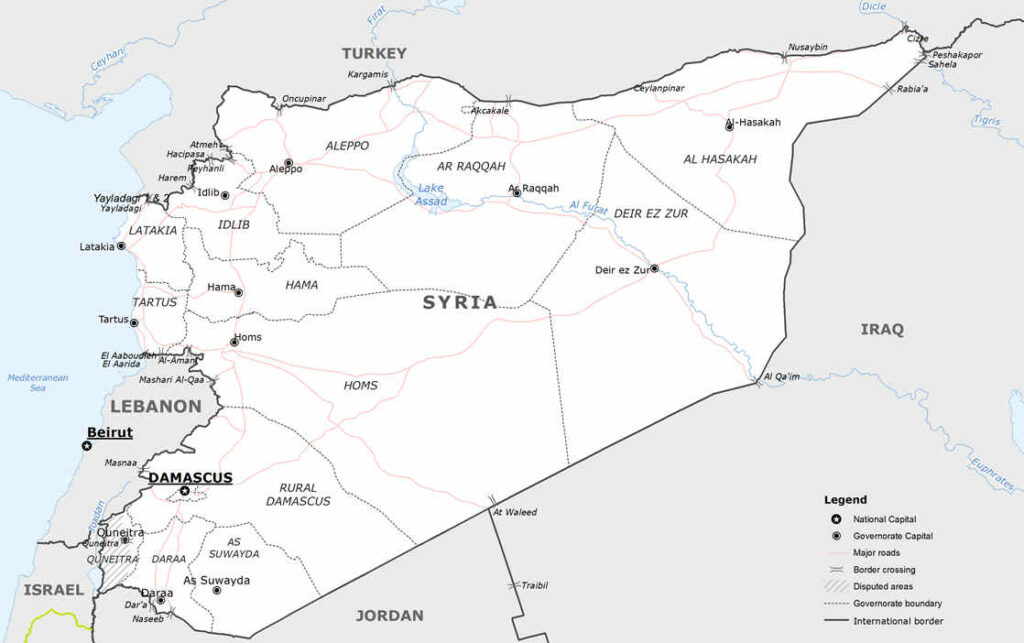

The majority of Syria’s oil reserves are located in the eastern and northeastern regions, particularly in the Deir ez-Zor, Hasakah, and Raqqa provinces. These regions have historically been the backbone of Syria’s oil industry, and before the war, they accounted for over 90% of the country’s crude oil production. However, the ongoing conflict, along with the loss of control over these territories to various foreign and domestic factions, has significantly disrupted oil production.

Syria’s Declining Oil Production

Syria’s oil production has drastically declined since the beginning of the civil war. In 2010, Syria was producing an estimated 385,000 barrels per day (bpd). By 2018, this figure had plummeted to just 24,000 bpd, primarily due to the destruction of oil infrastructure and the loss of control over major oil fields. The economic sanctions imposed by the international community, particularly the U.S. and EU, further exacerbated Syria’s ability to maintain or increase production.

In 2020, Syria’s oil production was estimated to have fallen even further, with production rates hovering around 30,000 barrels per day, which is a fraction of the country’s pre-war output. The U.S. sanctions, along with the control of key oil fields by U.S.-backed Kurdish forces, have left the Syrian government with limited access to oil resources, thus impeding its recovery efforts.

Natural Gas Reserves and Production in Syria

Syria also has significant natural gas reserves, though these reserves have been overshadowed by its oil resources. As of the most recent data, Syria’s proven natural gas reserves are estimated to be around 8.5 trillion cubic feet (Tcf). The majority of Syria’s gas fields are located in the central and eastern parts of the country, particularly in the Palmyra region, which was once a critical area for natural gas production.

Before the conflict, Syria’s natural gas production was around 8 million cubic meters per day (Mcm/d), and gas was a vital source of energy for both domestic consumption and electricity generation. However, much like the oil sector, Syria’s natural gas industry has also suffered due to the war. The damage to critical infrastructure and the seizure of gas fields by opposition groups and ISIS has resulted in a sharp decline in production. By 2018, gas production had dropped to an estimated 4 million cubic meters per day, and it has remained low in subsequent years.

The Impact of War on Oil and Gas Infrastructure

The impact of Syria’s ongoing civil war on the country’s oil and gas infrastructure has been devastating. Key oil fields and natural gas facilities have been destroyed, looted, or taken over by opposing factions. The loss of control over the lucrative Al-Omar and Al-Tanak oil fields in Deir ez-Zor is a notable example of how the conflict has shifted control of energy resources.

In addition, airstrikes and ground battles have severely damaged pipelines, refineries, and storage facilities, further complicating efforts to restore production. The ongoing presence of ISIS and other militant groups has also led to sabotage and theft of oil, further diminishing Syria’s energy output.

Syrian Oil and Gas Industry in 2024

As of December 8th, 2024, the Syrian oil and gas industry is in a state of flux following the fall of the Assad regime. The country’s energy resources are divided among various factions, complicating the future of the sector.

A significant portion of Syria’s oil and gas infrastructure, particularly in the northeast, is currently under the control of U.S.-backed Kurdish forces. These forces have established a degree of autonomy and control over oil and gas production in the region. However, the future of these areas remains uncertain, as the broader geopolitical landscape in the Middle East continues to evolve.

The collapse of the Assad regime has created a power vacuum, and various groups are vying for control over Syria’s resources. The new political landscape will likely shape the future of the oil and gas sector, influencing factors such as production levels, export routes, and revenue distribution.

Any future government will need to address the complex geopolitical dynamics and establish a stable environment to attract foreign investment and rebuild the country’s energy infrastructure. The ability to unify the country, reconcile different factions, and implement effective economic policies will be crucial for the revival of Syria’s oil and gas industry.

Conclusion

Syria’s oil and gas reserves hold significant potential, but the ongoing conflict and political instability continue to restrict the country’s ability to fully utilize these resources. With proven reserves of approximately 2.5 billion barrels of oil and 8.5 trillion cubic feet of natural gas, Syria’s energy sector could play a crucial role in its long-term economic recovery. However, the road to recovery will be a challenging one, requiring both political stabilization and the rebuilding of critical infrastructure.