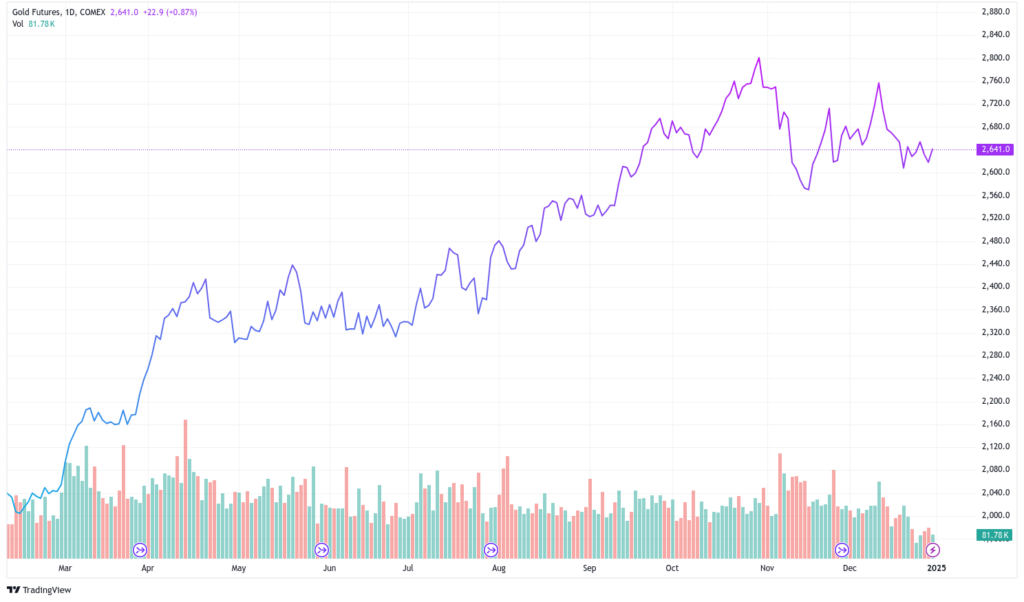

The year 2024 proved to be an exceptional one for gold, as the yellow metal defied expectations and delivered impressive gains. By the end of the year, its price had surged by nearly 27%, marking one of its best performances of the century. This rally was the largest since 2010, with gold reaching a peak of $2,790 per ounce in late October before settling at around $2,626.80 by December. The rise was a remarkable achievement, especially given the headwinds from a stronger U.S. dollar and rising real Treasury yields—factors that typically weigh on the appeal of gold.

As we shift our focus toward 2025, the key question is whether this strong performance can continue. Various factors, such as U.S. Federal Reserve policies, global economic trends, and geopolitical risks, will determine the direction of gold’s price in the coming year. Here, we’ll take a closer look at what fueled gold’s stellar performance in 2024 and explore the key drivers that may shape its trajectory in 2025.

2024: Gold’s Remarkable Surge

Several factors came together in 2024 to fuel the gold rally. The year saw gold outperform most other commodities, with its price reaching record levels. Central bank policies, persistent inflation, and geopolitical uncertainties all contributed to its strong showing.

U.S. Federal Reserve’s Monetary Policy and Interest Rate Cuts

A significant catalyst for gold’s rise in 2024 was the U.S. Federal Reserve’s monetary policy. After a period of aggressive interest rate hikes, the Fed shifted course and cut rates three times during the latter half of the year—in September, November, and December. These rate cuts helped lower the cost of borrowing and reduced the yields on U.S. Treasury bonds, making these traditional safe-haven investments less attractive relative to gold.

As a non-yielding asset, gold benefits when interest rates fall or remain low. With the U.S. central bank taking a more dovish stance, investors found fewer reasons to park their money in yield-bearing assets. Consequently, they increasingly turned to gold as a store of value. The declining real yields—which represent the difference between nominal interest rates and inflation—further boosted the allure of the yellow metal, as investors sought a hedge against rising prices.

Inflation Concerns and Safe-Haven Demand

Inflation remained a persistent concern throughout 2024, contributing to gold’s appeal as a safe-haven investment. Although inflation slowed from its peak in 2022, it remained elevated compared to historical norms, particularly in the U.S. and Europe. This elevated inflation made gold an attractive option for those looking to preserve purchasing power in the face of rising prices.

Gold has historically served as a reliable hedge against inflation. While currencies and bonds can lose value over time during inflationary periods, gold has maintained its purchasing power over centuries, making it an appealing asset for investors looking for long-term stability. As inflation continued to weigh on economies, demand for gold as an inflationary hedge drove its price higher throughout the year.

Geopolitical Tensions and Increased Demand for Stability

Geopolitical instability also played a significant role in supporting gold prices in 2024. From the ongoing war in Ukraine to tensions between the U.S. and China, global uncertainties pushed investors toward assets perceived as more secure. In times of geopolitical turmoil, gold is often viewed as a safe-haven asset—one that retains value when stock markets and other riskier assets are under pressure.

Whether driven by military conflicts or political instability, the global landscape in 2024 kept investors on edge. This uncertainty led many to seek refuge in gold, further elevating demand for the precious metal. Gold’s historical role as a store of value during periods of crisis has cemented its position as a preferred asset in times of geopolitical risk.

Central Bank Gold Buying

In addition to individual investors, central banks also played a key role in gold’s strong performance. In 2024, central banks, particularly in emerging markets, continued to add to their gold reserves. Countries like China, Russia, and India were among the largest buyers, diversifying away from the U.S. dollar and seeking to bolster their financial stability.

The growing trend of central bank gold buying has been a significant factor driving the metal’s price in recent years. As central banks seek to strengthen their reserves amid economic uncertainty, their demand for gold helps sustain upward pressure on prices. The shift toward gold as a reserve asset is likely to persist into 2025, further supporting its value.

What Lies Ahead for Gold in 2025?

Looking ahead, several key factors will shape gold’s performance in 2025. While the market is expected to remain strong, there are challenges that could temper its growth. The dynamics of U.S. Federal Reserve policy, global economic trends, inflation expectations, and geopolitical risks will all play a role in determining whether gold can maintain its momentum into the next year.

U.S. Federal Reserve and Interest Rate Outlook

The Federal Reserve’s actions in 2025 will be pivotal in shaping the direction of gold prices. The Fed’s decision to cut interest rates in 2024 was a major contributor to gold’s rise, but the outlook for 2025 is less clear. The central bank has hinted that rate cuts may slow down in the coming year, and its future moves will depend on a range of economic factors, including inflation and growth.

If inflation continues to rise or if economic conditions become more unstable, the Fed may continue its dovish approach, keeping interest rates low and making gold an attractive investment. Conversely, if inflation starts to subside and the economy strengthens, the Fed could resume tightening, raising interest rates and diminishing gold’s appeal. The outlook for real yields will remain a key determinant of gold’s performance. Should yields rise significantly, it may put downward pressure on the precious metal.

Economic Slowdown and Recession Risks

In 2025, concerns over global economic growth will likely continue to influence gold prices. If the global economy enters a recession, gold could benefit as investors seek safe-haven assets. A slowing economy, combined with stagflation (high inflation paired with weak growth), would create an environment in which gold historically performs well.

During periods of economic contraction, gold tends to hold its value better than most assets. If the U.S. or major European economies face a downturn, the demand for gold as a store of value may increase, boosting its price.

Persistent Inflation and the Search for Safe-Havens

While inflation may moderate slightly in 2025, it is expected to remain a central concern for many investors. If inflation persists at elevated levels, gold will likely continue to be seen as an effective hedge against rising prices. Central banks may be reluctant to raise interest rates aggressively, which would keep real yields low and maintain gold’s attractiveness.

As long as inflation remains a significant issue, the demand for gold as a hedge is likely to stay strong. Investors seeking to protect their purchasing power will likely turn to precious metals, and gold will continue to be a go-to asset for those looking for long-term wealth preservation.

Geopolitical Risks and Gold’s Safe-Haven Role

Geopolitical risks will also continue to play a major role in gold’s prospects. With ongoing global tensions—such as the war in Ukraine, trade disputes between the U.S. and China, and volatility in the Middle East—there is a high likelihood that gold will remain a favored asset for investors looking to shield their portfolios from risk.

Gold’s ability to retain value during times of political instability is one of its key attributes, and any escalation in geopolitical tensions could trigger a renewed surge in demand. In 2025, the uncertainty surrounding the U.S.-China trade relationship, as well as the evolving geopolitical landscape, could keep investors cautious and more inclined to hold gold as a safe-haven asset.

China’s Economic Recovery and Its Impact on Gold

As the second-largest economy in the world, China’s economic performance will be crucial in determining gold’s direction. While China has faced significant economic challenges in recent years, particularly with its real estate sector and a slowdown in growth, there are signs that the country could experience a recovery in 2025.

A recovery in China could increase demand for gold, especially if the Chinese currency strengthens against the dollar. Moreover, China’s ongoing strategy to diversify away from the U.S. dollar and increase its gold reserves will likely support demand for the precious metal in the years ahead. Should the Chinese economy pick up steam, it could provide a boost to gold prices, particularly if it leads to an increase in Chinese consumer demand for the metal.

Navigating the Gold Market in 2025

As 2025 unfolds, gold will likely remain an essential part of many investment portfolios, offering a hedge against inflation, geopolitical risks, and economic uncertainty. The year ahead presents opportunities for the precious metal, but also potential risks, especially if interest rates rise or economic conditions stabilize.

For investors, the key to navigating the gold market will be closely monitoring central bank policies, particularly the Federal Reserve’s stance on interest rates, as well as global economic developments. Geopolitical tensions and the economic policies of major players like China will also be critical to understanding gold’s price movements. As the world continues to face uncertainty, gold’s role as a safe-haven asset will likely keep it in high demand, making it a key player in the financial landscape of 2025.