Introduction

Bitcoin has always inspired bold predictions. From early adopters who viewed it as a revolutionary form of money to institutional investors who see it as digital gold, debate over its ultimate value remains fierce. As of now, Bitcoin trades in the low six figures, far from the million-dollar price targets long promised by its most devoted believers.

Cathie Wood of ARK Invest continues to predict that Bitcoin will reach one million dollars or more by 2030. Jack Dorsey, cofounder of Twitter and CEO of Block, has echoed a similar expectation, saying Bitcoin could exceed that mark before the decade ends. While these forecasts ignite enthusiasm, they also invite skepticism.

This feature examines three realistic long-term scenarios for Bitcoin’s price: a moderate growth path, a bullish institutional surge, and a full-scale paradigm shift. Each path reflects different economic, regulatory, and social conditions, and each is supported by commentary and forecasts from leading Bitcoin proponents.

Scenario 1: Moderate Growth

In the moderate growth scenario, Bitcoin continues to appreciate steadily but not explosively. It becomes further integrated into mainstream portfolios, serves as a credible hedge against inflation, and remains attractive to investors seeking an alternative to fiat currencies. Yet its rise stays measured.

In this environment, institutional adoption grows through regulated exchange-traded funds and corporate treasuries. Governments provide clearer but cautious oversight. Bitcoin’s supply cap of twenty-one million coins sustains its scarcity narrative, while competition from stablecoins and other blockchain projects keeps its price grounded.

Bernstein Research estimated in 2024 that Bitcoin could reach one million dollars by 2033. Other analyses, such as those published by Bitcoin Magazine, suggest it may settle closer to five hundred thousand before the decade closes.

Jack Dorsey summed up a common sentiment when he said, “For me, there is no obvious logical reason why we are only at one hundred thousand. It’s not very high considering all the changes compared to a couple of years ago.”

This moderate path assumes the world’s major economies accept Bitcoin as a legitimate asset but avoid treating it as a monetary standard. Under these conditions, Bitcoin could mature into a stable store of value trading in the high six-figure range by the 2030s.

Scenario 2: Bullish Surge

The bullish surge scenario envisions Bitcoin entering a new phase of institutional acceleration. Large financial entities, pension funds, and sovereign wealth funds allocate significant holdings. Governments refine crypto-friendly frameworks that attract capital. Demand for a neutral, decentralized asset rises as traditional currencies face pressure from inflation and political volatility.

Cathie Wood’s team at ARK Invest maintains that if institutions dedicate just five percent of their portfolios to Bitcoin, prices could exceed 1.5 million dollars. MicroStrategy’s Michael Saylor has gone even further, predicting valuations as high as 13 million dollars by 2045.

Saylor explained his conviction by contrasting Bitcoin with physical stores of value: “Physical assets might last a thousand years but probably about fifty to seventy-five years is the best you’re going to get. Bitcoin is immortal, immutable and immaterial.”

For this surge to materialize, three forces must align. First, institutional capital must deepen well beyond today’s levels. Second, regulatory consistency must emerge across key markets, reducing friction for global investors. Third, Bitcoin must continue to deliver on its core proposition as a scarce, censorship-resistant asset.

Risks remain. A large-scale regulatory backlash or technological failure could slow adoption. Competing protocols might erode Bitcoin’s dominance. And if macroeconomic stability returns, enthusiasm for alternative assets could cool.

If these challenges are overcome, however, Bitcoin could easily surpass one million dollars per coin within a decade. At that stage, it would not merely coexist with gold as a store of value but stand beside it as an institutional pillar of wealth preservation.

Scenario 3: The Paradigm Shift

The third scenario describes a transformational future in which Bitcoin transcends its current role and becomes an integral part of the global financial system. Central banks, sovereign wealth funds, and corporations hold Bitcoin as a reserve asset. Global trade, lending, and settlement systems adapt to accommodate it.

In this vision, Bitcoin evolves into a universal financial foundation rather than an investment product. Circulating supply tightens as long-term holders and institutions secure their coins indefinitely. Nations facing unstable currencies adopt Bitcoin as a hedge against fiat decline.

Some long-range forecasts illustrate this extreme possibility. Reports summarized by Bitcoin Magazine cite estimates from Fidelity suggesting that Bitcoin could reach hundreds of millions of dollars per coin in the distant future. While that number may seem extraordinary, it captures the belief that Bitcoin could one day replace or complement existing monetary systems.

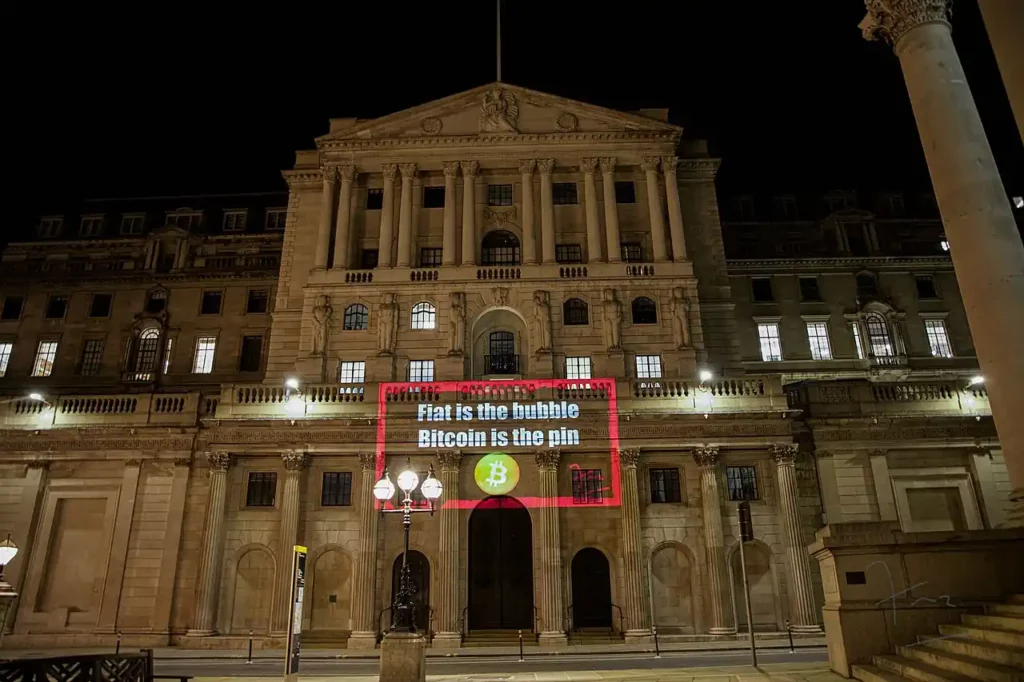

Investor Chamath Palihapitiya described Bitcoin as “a hedge and a store of value against autocratic regimes and banking infrastructure.” His view reflects a broader philosophical argument: that Bitcoin represents financial independence and resistance to centralized control.

This paradigm shift depends on dramatic geopolitical and technological changes. It assumes that governments embrace decentralized money, that security against quantum threats remains strong, and that global trust in fiat currencies continues to erode. Even if all these factors converge, the transition would likely take decades.

If it did occur, Bitcoin would cease to be merely an asset and would instead operate as a parallel monetary standard. Prices in the multi-million range would be not speculation but reflection of a fundamentally restructured global economy.

Comparing the Paths

The three paths differ in scale and pace rather than direction. Each scenario presumes that Bitcoin retains its relevance, continues to attract capital, and remains technically sound.

The moderate outcome imagines Bitcoin as a mature store of value. The bullish surge positions it as a mainstream institutional asset rivaling gold. The paradigm shift sees it becoming a universal reserve currency.

Among these, the bullish surge appears most plausible in the near term. Regulation is improving, institutional participation is rising, and Bitcoin’s scarcity continues to strengthen its investment case. The paradigm shift remains aspirational but not impossible. History shows that financial paradigms can change faster than expected when trust in existing systems breaks down.

Voices Behind the Forecasts

Prominent Bitcoin advocates continue to project strong future growth. Cathie Wood’s ARK Invest maintains a one-million-dollar target by 2030. Robert Kiyosaki, author of Rich Dad Poor Dad, has made a similar prediction. Cantor Fitzgerald analysts and even members of the Trump family have voiced expectations of a seven-figure Bitcoin price within the next decade.

These forecasts often spark skepticism, yet they emphasize a key point: Bitcoin’s value is driven not only by economics but by belief. Its market behavior reflects the strength of its narrative as much as its technical fundamentals. That combination of ideology and scarcity makes Bitcoin unlike any asset before it, which explains why projections vary so widely.

A Measured Outlook

From a pragmatic perspective, Bitcoin has already achieved what many once thought impossible. It survived regulatory attacks, market crashes, and technological challenges, and it remains a trillion-dollar network with global reach.

The next phase depends on several measurable factors: how much institutional capital enters the market, how regulators define long-term rules, and whether macroeconomic instability continues to fuel interest in hard digital assets.

If governments and corporations continue to integrate Bitcoin into their balance sheets, the million-dollar milestone could eventually become a reality. If global stability returns and risk appetite declines, Bitcoin may level off below that point yet remain a cornerstone of alternative finance.

Conclusion

Bitcoin’s journey from a 2009 experiment to a global financial asset has already changed the world. Whether it reaches one million dollars or not, it has redefined how people think about money, scarcity, and trust.

The question is no longer whether Bitcoin will survive. It is whether it will evolve into a mainstream financial constant or transform into a foundation of a new global system.

Either path would confirm that Bitcoin’s influence extends far beyond price speculation. It represents a movement toward digital sovereignty, economic resilience, and the democratization of value itself.