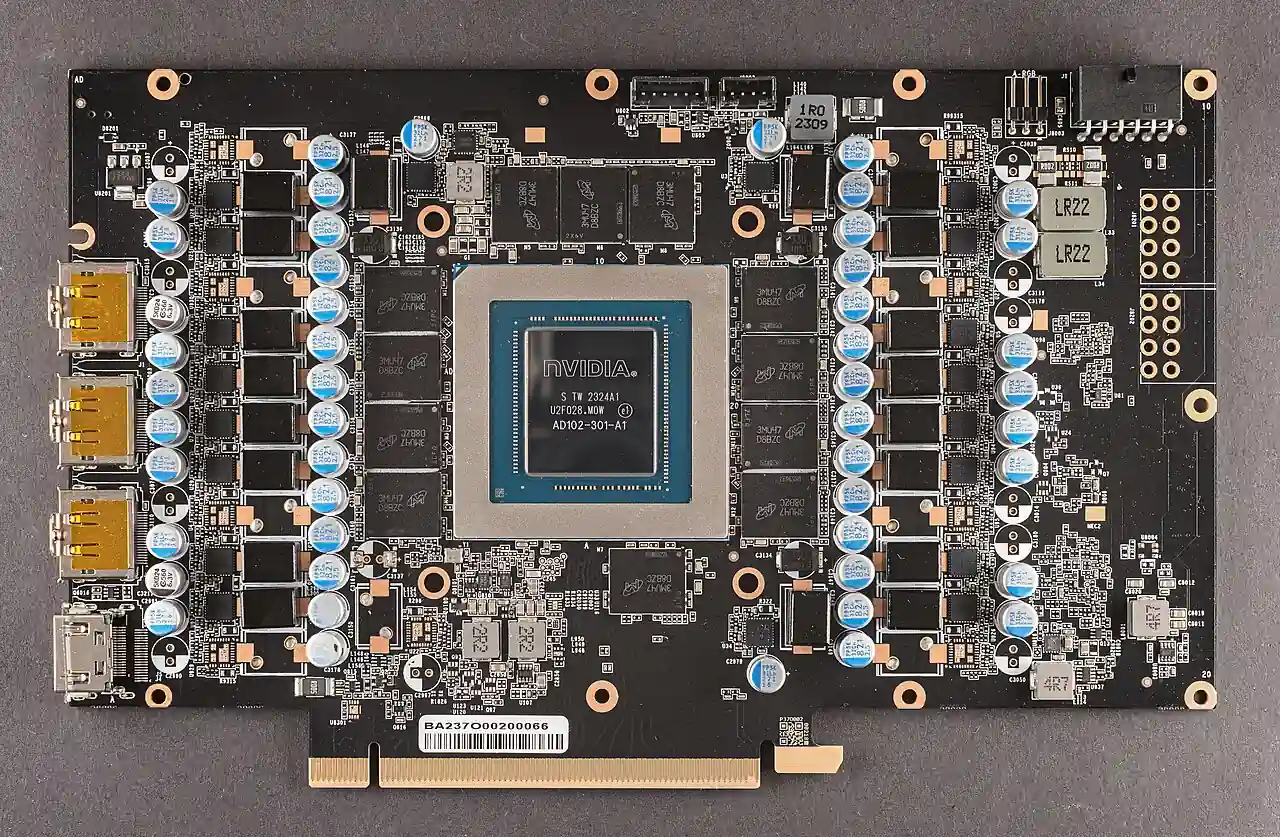

The Memory Shortage and the Cost of Technology in 2026

The global memory shortage in 2026 is significantly affecting the technology industry. Rising DRAM and high-bandwidth memory prices are driving higher costs for smartphones, personal computers, servers, and network equipment. Shipment forecasts are slowing, average selling prices are climbing, and manufacturers are adjusting specifications to manage supply constraints.